Insurance is like a safety net, providing you with a sense of security and peace of mind. It’s a financial tool that can protect you, your family, and your assets from unforeseen circumstances. In this comprehensive guide, we’ll explore various types of insurance that are crucial for safeguarding your finances.

Introduction to the World of Insurance

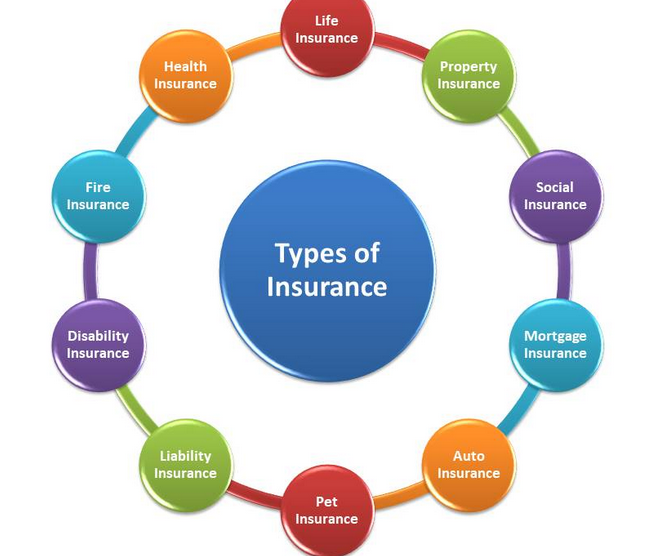

Insurance is an agreement between you and an insurance company where, in exchange for regular premium payments, the company provides financial coverage for specific risks. It’s a proactive approach to managing and mitigating risks that life can throw your way. Types of insurance vary, each tailored to address specific areas of concern.

Understanding the types of insurance available is essential in making informed decisions about protecting your finances and family from potential setbacks. Let’s delve into the key categories of insurance to ensure you’re adequately covered.

Health Insurance

Health insurance is perhaps the most fundamental insurance type to have. It provides coverage for medical and surgical expenses incurred due to illness or injury. Without health insurance, medical bills can accumulate and put a significant strain on your finances.

Having health insurance ensures you receive proper medical care without worrying about the hefty costs associated with it. It covers hospitalization, doctor visits, medications, and preventive care. Additionally, health insurance plans often offer benefits like dental and vision coverage, making it a comprehensive solution for your health needs.

Auto Insurance

Auto insurance is vital for anyone who owns a vehicle. Accidents can happen at any time, and being unprepared can result in financial devastation. Auto insurance covers damages to your car and other vehicles involved in an accident, medical expenses, and liability for injuries and property damage to others.

With various options available, from liability to comprehensive coverage, you can tailor your auto insurance policy to suit your needs and budget. Having this insurance gives you the confidence to drive, knowing you’re protected financially in case of an unfortunate event.

Life Insurance

Life insurance provides financial protection to your family in case of your untimely demise. It ensures your loved ones are taken care of by providing a lump sum or periodic payments, depending on the policy, to cover expenses like mortgages, education, and everyday living costs.

Life insurance comes in various forms, including term life, whole life, and universal life. It’s a crucial investment, especially if you have dependents relying on your income. Planning for the unexpected through life insurance is a responsible way to guarantee a secure financial future for your family.

Disability Insurance

Disability insurance is often overlooked but is a critical component of your financial safety net. It provides a source of income in case you’re unable to work due to an injury or illness. Without your ability to work and generate income, your financial stability can quickly crumble.

Disability insurance ensures that even if you can’t work, you can still meet your financial obligations, such as mortgage payments, bills, and living expenses. It’s a precautionary measure that can make a significant difference during challenging times.

Travel Insurance

Travel insurance is essential for anyone planning a trip, whether it’s a domestic getaway or an international adventure. It covers unforeseen circumstances during travel, such as trip cancellations, delays, lost luggage, or medical emergencies.

Having travel insurance provides peace of mind, knowing that you’re financially protected if something goes wrong during your travels. It allows you to focus on enjoying your trip without worrying about the potential financial burdens of unexpected incidents.

Pet Insurance

Pets are an integral part of our families and their health and well-being matter. Pet insurance covers medical expenses for your furry companions, including surgeries, medications, and routine check-ups.

Conclusion

In a world full of uncertainties, having the right insurance coverage is a smart financial decision. It’s an investment in your peace of mind and the well-being of your family. Assess your needs, consult with insurance professionals, and choose the insurance types that align with your lifestyle and circumstances. With the right insurance, you can build a secure future and enjoy life without the constant worry of financial risk.